Home depreciation calculator

For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. Real Estate Property Depreciation Calculator Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation.

Depreciation Formula Calculate Depreciation Expense

Percentage of square feet.

. Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset. Add that to your 170000 for a building cost basis of 180000. There are many variables which can affect an items life expectancy that should be taken into consideration.

Depreciated over 275 years that comes to 6545 in annual. First one can choose the. You can calculate this percentage in one of two ways.

Section 179 deduction dollar limits. It provides a couple different methods of depreciation. There are many variables which can affect an items life expectancy that should be taken into consideration.

C is the original purchase price or basis of an asset. Fortunately our BRRRR Calculator breaks the. Weve created the Home Appreciation Calculator to determine the ROI on your real estate investment.

You make 10000 in capital improvements. The property depreciation calculator shows your property depreciation schedule year by year the schedule includes Beginning Book Value Depreciation Percent Depreciation Amount. Select Property Type Construction Type Quality of Finish Floor Area Estimated year of Construction Year of Purchase and the Closest Major City to your property then click Calculate.

The value of the home after n years A P 1 R100 n Lets suppose that the. Cost of asset salvage valueestimated useful life annual depreciation expense 600 1005 100 in annual depreciation expenses As for the residence itself. Each step in the Buy Rehab Rent Refinance Repeat BRRRR requires detailed analysis before you proceed with the deal.

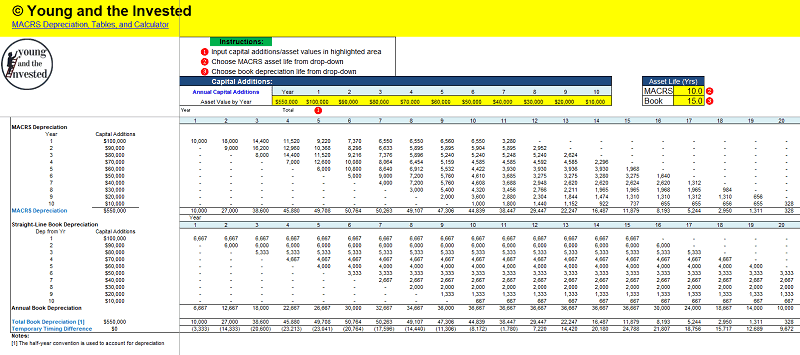

In most cases the amortized payments are fixed monthly payments spread evenly. The MACRS Depreciation Calculator uses the following basic formula. D i C R i.

Measure the size of your home office and measure the overall size of your home. The calculator should be used as a general guide only. Nonetheless our mortgage amortization calculator is specially designed for home mortgage loans.

The calculator should be used as a general guide only. This limit is reduced by the amount by which the cost of. A 250000 P 200000 n 5.

Use this tool to plan your financial future and determine what you can expect the. Where Di is the depreciation in year i. Calculate the average annual percentage rate of appreciation.

Residential Rental Property Depreciation Calculation Depreciation Guru

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Depreciation Calculator For Home Office Internal Revenue Code Simplified

Macrs Depreciation Calculator Straight Line Double Declining

Macrs Depreciation Calculator With Formula Nerd Counter

Free Macrs Depreciation Calculator For Excel

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

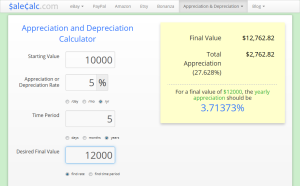

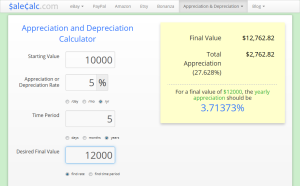

Appreciation Depreciation Calculator Salecalc Com

How To Use Rental Property Depreciation To Your Advantage

Units Of Activity Depreciation Calculator Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Residential Rental Property Depreciation Calculation Depreciation Guru

Residential Rental Property Depreciation Calculation Depreciation Guru

Macrs Depreciation Table Calculator The Complete Guide

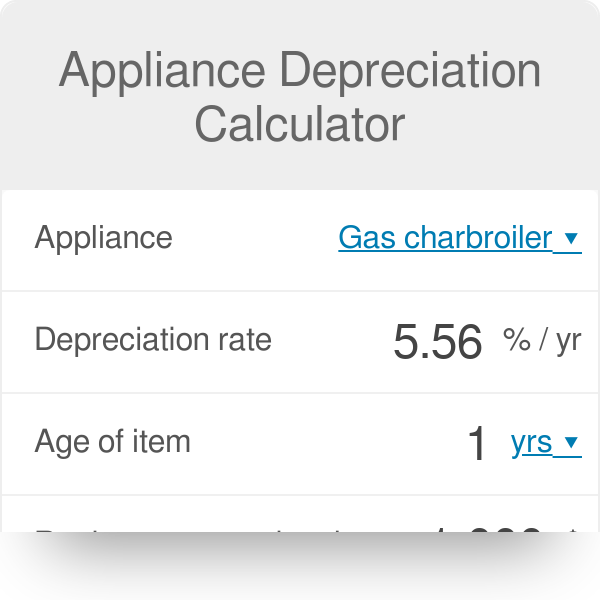

Appliance Depreciation Calculator

How Is Property Depreciation Calculated Rent Blog